Shift your focus to optimizing business strategies, let us handle the financial compliance.

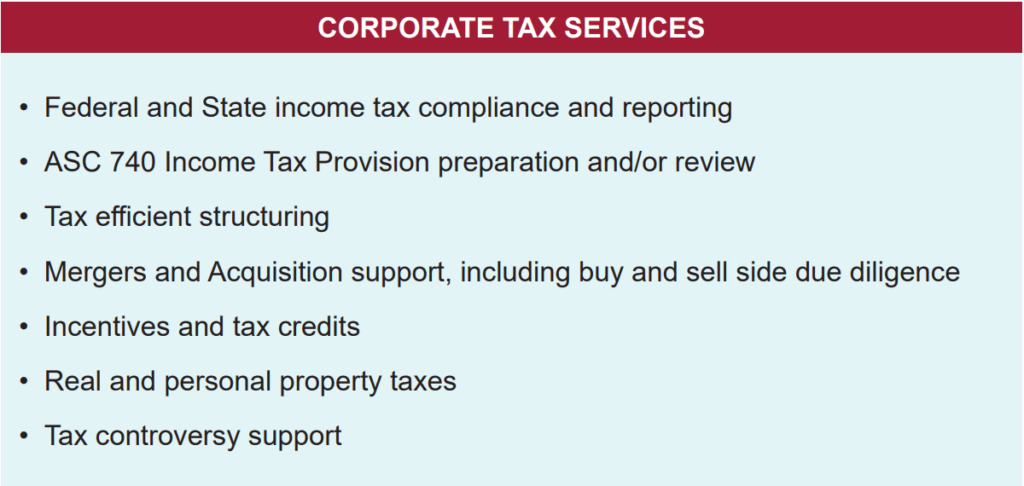

In the complex corporate environment, our teams can help your business navigate the complexities of financial statement reporting for income taxes (ASC 740) with tax provision preparation and disclosure. Additionally, our teams can advise on tax efficient corporate structures and assist with transactional support around mergers and acquisitions, including buy and sell side due diligence. As your business grows and expands BRC will be with you to advise on available credits and incentives to help off-set the capital investment required. We are also here to support your business with tax controversy issues with Federal and State taxing authorities ranging from audit support to tax notice resolution.

INDUSTRIES WE SERVE

- Manufacturing and Distribution

- Wholesale and Retail

- Transportation and Logistics

- Professional Service Corporations

- Food and Beverage

- Dealerships

- Construction and Real Estate

Charles Thurman CPA, Tax Principal

Charles serves as a Tax Principal in the Greensboro office of Bernard Robinson & Company (BRC). He has more than 23 years of experience serving in both public accounting and industry. Charles is responsible for providing tax compliance and consulting services to a wide variety of clients with a focus on serving C-Corporation clients with […]