Affordable Housing Industry Accounting Services

Our affordable housing industry accounting practice is one of the firm’s largest and most experienced service areas. We provide assurance, tax and advisory services to more than 1000 affordable housing entities located throughout the United States. Our clients encounter unique and sometimes nearly impossible obstacles in developing and maintaining affordable housing properties. We take great pride in helping our clients succeed in this industry and take great pride in providing hands‐on guidance to navigate the technical and regulatory requirements of the affordable housing industry.

Our affordable housing industry accounting practice is one of the firm’s largest and most experienced service areas. We provide assurance, tax and advisory services to more than 1000 affordable housing entities located throughout the United States. Our clients encounter unique and sometimes nearly impossible obstacles in developing and maintaining affordable housing properties. We take great pride in helping our clients succeed in this industry and take great pride in providing hands‐on guidance to navigate the technical and regulatory requirements of the affordable housing industry.

To secure tax-exempt financing, tax credits, and other advantages associated with Affordable Housing programs, organizations must adhere to intricate and sometimes challenging regulatory and reporting requirements. Failure to comply could result in losing these benefits and possibly hinder future participation in Affordable Housing initiatives.

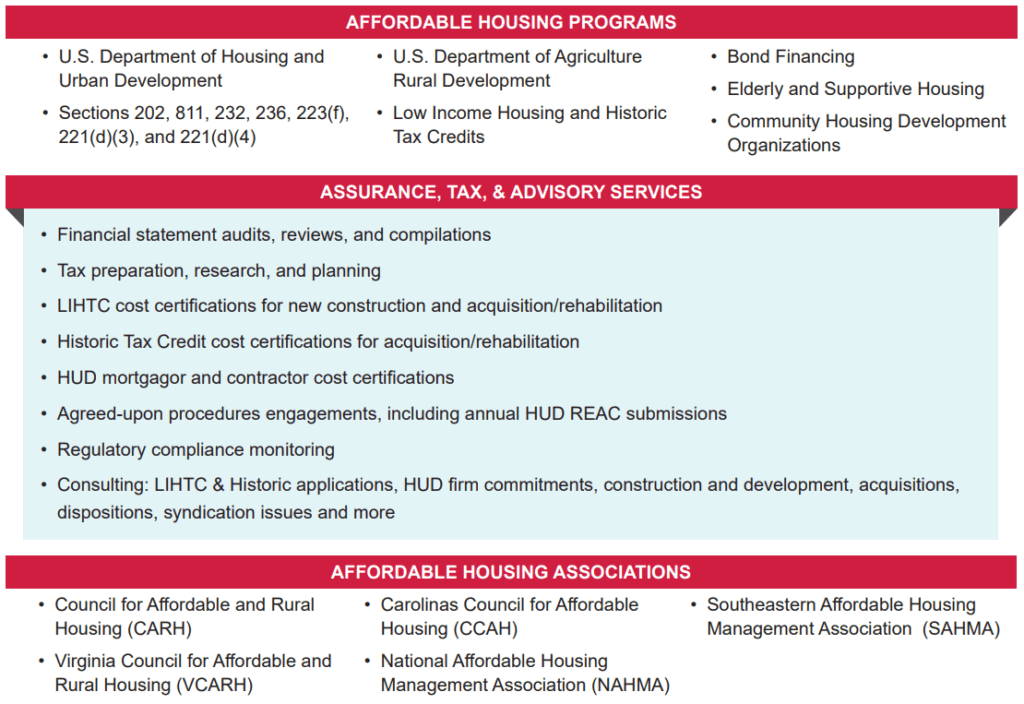

- U.S. Department of Housing and Urban Development

- Sections 202, 811, 232, 236, 223(f), 221(d)(3), and 221(d)(4)

- U.S. Department of Agriculture Rural Development

- Low Income Housing and Historic Tax Credits

- Bond Financing

- Elderly and Supportive Housing

- Community Housing Development Organizations

- Financial statement audits, reviews, and compilations

- Tax preparation, research, and planning

- LIHTC cost certifications for new construction and acquisition/rehabilitation

- Historic Tax Credit cost certifications for acquisition/rehabilitation

- HUD mortgagor and contractor cost certifications

- Agreed-upon procedures engagements, including annual HUD REAC submissions

- Regulatory compliance monitoring

- Consulting: LIHTC & Historic applications, HUD firm commitments, construction and development, acquisitions, dispositions, syndication issues, and more

- Council for Affordable and Rural Housing (CARH)

- Virginia Council for Affordable and Rural Housing (VCARH)

- Carolinas Council for Affordable Housing (CCAH)

- National Affordable Housing Management Association (NAHMA)

- Southeastern Affordable Housing Management Association (SAHMA)

Let’s get started today!

Erica Vernon Assurance Partner

"Affordable Housing is one of our largest practice areas at BRC. Our team has been collaborating with clients on Affordable Housing and tax incentivized approaches to real estate since this industry formalized almost thirty years ago. We enjoy working with clients to plan their best course of action based on their particular set of circumstances."

Affordable Housing TEAM

- Jennifer Burris Tax Senior Manager, CPA

- Elizabeth Danner Partner, CPA

- Tonia H. Hedrick Principal, CPA

- Allison Mills Principal, CPA

- Olga Oganesov Tax Principal, CPA

- Jamie L. Parsons Assurance Practice Area Leader, Partner, CPA

- Casey Patterson Tax Partner, CPA

- Robin Redding Principal, CPA

- Kimberly Jessup Ripberger Chief People Officer, Assurance Partner, CPA

- Brie E. Sisak Senior Assurance Manager, CPA

- Tim Smith Partner, CPA

- Irish Thurston Senior Tax Manager, CPA

- Erica B. Vernon Partner, CPA

- Brittany Gordon Worley Senior Assurance Manager, CPA